PAYROLL

Payroll is the process of maintaining records of all employee

salary under various pay head, all statutory and non- statutory deduction

attendance/ absent record.

Working steps:-

Create a company and then activate payroll as follow:

To Activate

Payroll: - G.O.T. (Gateway of Tally)--> Press F11 (Company Features)--> Press F1 (Accounting

Features).

Create attendance/ production types as follow:-

Path for attendance/

production types creation: - G.O.T. (Gateway of Tally)--> Payroll Info--> Attendance/ Production Types --> Create.

Here, press “Alt + C” to create unit as follow:-

And then accept the attendance type:-

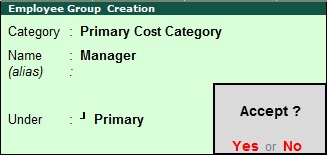

After that create employee group:-

Path for employee

group creation: - G.O.T. (Gateway of Tally)--> Payroll Info--> Employee Group --> Create (Single).

And then create employee:-

Path for

employee creation: - G.O.T. (Gateway of Tally)--> Payroll Info--> Employees--> Create (Single).

Create pay head:-

Path for pay

head creation: - G.O.T. (Gateway of Tally)--> Payroll Info--> Pay Heads --> Create.

Create salary detail of Ram and Shyam:-

Path for salary

detail creation of Ram: - G.O.T. (Gateway of Tally)--> Payroll Info--> Salary Detail --> Create--> Ram.

Path for salary

detail creation of Shyam: - G.O.T. (Gateway of Tally)--> Payroll Info--> Salary Detail --> Create--> Shyam.

Now do voucher entry as follow:-

Path for voucher

creation: - G.O.T. (Gateway of Tally)--> Payroll

Voucher--> Press Ctrl

+ F5.

Now press “Ctrl + F4” to open payroll voucher:-

Press “Alt + A” to auto fill information.

Now you can see the payroll report as follow:-

Path for

view report of payroll: - G.O.T. (Gateway of Tally)--> Display--> Payroll Report--> Statement of Payroll--> Pay Slip--> Ram/ Shyam.