VAT RETURN OR VAT USED IN CREDIT/ DEBIT NOTE OR VAT IN GOODS RETURN

It is used for purchase and sales

return under VAT. We can also adjust VAT return with purchase and sales

transaction.

Working steps:-

Create a company and then activate VAT:

To Activate

VAT: - G.O.T. (Gateway of Tally)--> Press F11

(Company Features)--> Press F3

(Statutory & Taxation).

And then create ledger:

Path for

ledger creation: - G.O.T. (Gateway of Tally)--> Accounts Info--> Ledger--> Create (Single).

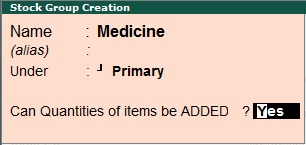

After that, create stock master as

follow:

To create

stock group: - G.O.T. (Gateway of Tally)à Inventory Infoà Stock Groupà Create (Single).

To create

stock item: - G.O.T. (Gateway of Tally)--> Inventory

Info--> Stock Item--> Create (Single).

And then do voucher entry as follow:-

Path for voucher

creation: - G.O.T. (Gateway of Tally)--> Inventory

Voucher--> Press F9

(Purchase Voucher).

Now activate debit and credit note:

To Activate

Debit and Credit Note: - G.O.T. (Gateway of Tally)--> Press F11 (Company Features)--> Press F1 (Accounting Features).

Again do voucher entry as follow:-

Now you can see the VAT report.

Path for

view VAT report: - G.O.T. (Gateway of Tally)--> Display--> Statutory Report--> VAT Report--> VAT Computation.

Press “Alt + F1” for more details.

This is really useful to every one who are interested to learn Tally ERP 9. Great Help to all and me

ReplyDeleteTally Sales

Thanks for sharing very nice and attractive post on accounting . we are also providing vat return filing and accounting service in dubai | procedure filing vat return dubai

ReplyDeleteIt has been just unfathomably liberal with you to give straightforwardly what precisely numerous people would've promoted for an eBook to wind up making some money for their end, basically given that you could have attempted it in the occasion you neededaccounting and bookkeeping services in dubai

ReplyDeleteI have read your blog and I gathered some needful information from your blog. Keep update your blog. Waiting for your next update. company services in india

ReplyDeleteKindly keep on writing these kind of blogs often as it is very helpful for me!

ReplyDeletevat return service In London

Its very well writen post and i really like this post.

ReplyDeleteVat Return Service in London

Thanks for sharing such an informative blog, it is very useful to the people who want to know about accounting services in Dubai.

ReplyDeleteaccounting services in Dubai, UAE

Excellent read, Positive site, I have read a few of the articles on your website now, and I really like your style. I really appreciate your work.If you require abouthow to register a startup company in bangalore | company registration cost bangalore please click on it.

ReplyDelete

ReplyDeleteThanks for sharing this Article,For More details click Here - Tally training in Chandigarh

Bookkeeping is usually performed by junior accountants and includes services such as accounts payable, receivables, payroll, bank reconciliations, monthly taxes, ledger entries and financial statements.

ReplyDeleteaccounting service dubai

This blog is really a great source of information for me. Thank you for sharing such a useful content about Vat Services UAE.

ReplyDeleteThanks for sharing such amazing post, i really liked it A VAT return is a structure that an organization should record with HMRC, typically at regular intervals. A total VAT return shows either cash owed to HMRC or whether an organization is expected a discount.

ReplyDeleteYou have given good information. Well, Anyone want to get VAT service in dubai then risians accounting firm best among the others.

ReplyDeleteThe finest course is regarded as being tally with gst course near me.

ReplyDeleteThank You!!

Excellente information chère, vous partagez toujours de la valeur.Calcul TVA

ReplyDeleteExcellent read, Positive site, I have read a few of the articles on your website now, and I really like your style. I really appreciate your work.If you require about

ReplyDeleteVAT Return Services in Barking

Very informative post! Understanding how VAT applies to credit notes, debit notes, and goods returns is crucial for accurate VAT return filing. Many businesses in the UAE struggle with these details, and professional VAT services in Dubai or experienced VAT consultants in Dubaican help ensure compliance, avoid errors, and streamline reporting. Proper VAT handling not only prevents penalties but also builds a strong financial foundation for business growth.

ReplyDeleteNice Post!!

ReplyDeletePlease look here at VAT Registration Services in Dubai