PROVISION

Provision is made for to escape from future losses.

It is created for future liability provision had

certain but provision amount is not certain.

It comes under Indirect Expenses.

Example:-

Goods sold to Rohan Rs. 50,000. Provision for debtors

is Rs. 10,000.

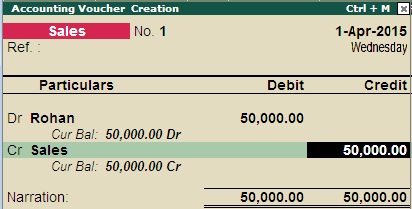

Do the above voucher entry.

To maintain:-

Create a company and then create ledger as follow:-

After that, do voucher entry as follow:-

Path for voucher creation:

- G.O.T. (Gateway of Tally)--> accounting voucher--> F8 (Sales Voucher).

Now do adjustment entries:

Create adjustment ledger as follow:-

Path for adjustment ledger creation:

- G.O.T. (Gateway of Tally)--> accounts info--> ledger--> create (single).

And then do voucher entry:-

Path for adjustment voucher creation:

- G.O.T. (Gateway of Tally)--> accounting voucher--> F7 (Journal Voucher).

View the profit and loss report:-

Path for view profit and loss report:

- G.O.T. (Gateway of Tally)--> Profit & Loss a/c.

Now view the balance sheet report as follow:-

Path for view Balance Sheet:

- G.O.T. (Gateway of Tally)--> Balance Sheet.

For more information press “Alt + F1”.

Online education through education ERP often presents a more cost-effective alternative to traditional classroom learning. Students can save on expenses related to commuting, housing, and physical study materials.

ReplyDeleteYour accounting abilities will improve as a result of accounting training at Kerala's Best Accounting Training Institute.

ReplyDeleteThanks for sharing!!