VAT TAX CLASS

VAT Tax

Class is used to pre - define a ledger specified in Purchase/ Sales Voucher.

Working

steps:-

Create a company and then activate VAT as follow:-

To Activate

VAT: - G.O.T. (Gateway of Tally)--> Press F11

(Company Features)--> Press F3

(Statutory & Taxation).

And then

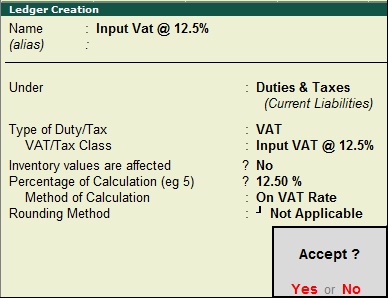

create ledger as follow:-

Path for

ledger creation: - G.O.T. (Gateway of Tally)--> Accounts Info--> Ledger--> Create (Single).

Create stock master as follow:-

To Create

Stock Group: - G.O.T. (Gateway of Tally)--> Inventory Info--> Stock Group--> Create.

To Create

Stock Item: - G.O.T. (Gateway of Tally)--> Inventory

Info--> Stock Item--> Create--> Press F12 (Configuration).

Now alter in voucher types (purchase and sales) as follow:-

Path for Purchase Voucher Type Alteration: - G.O.T. (Gateway of Tally)--> Inventory Info--> Voucher Types--> Alter--> Purchase.

Path for Sales Voucher Type Alteration: - G.O.T. (Gateway of Tally)--> Inventory Info--> Voucher Types--> Alter--> Sales.

After that do purchase voucher entry:-

Path for

voucher creation: - G.O.T. (Gateway of Tally)--> Inventory Voucher--> Press F9 (Purchase Voucher)--> Purchase Class.

And then do

sales voucher entry:-

Path for

voucher creation: - G.O.T. (Gateway of Tally)--> Inventory Voucher--> Press F8 (Sales Voucher)--> Sales Class.

You can see the VAT computation:-

Path for

view VAT computation: - G.O.T. (Gateway of Tally)--> Display-->Statutory Report--> VAT Report--> VAT Computation.

Now create

voucher types:-

Path for Voucher Type Creation: - G.O.T. (Gateway of Tally)--> Inventory Info--> Voucher Types--> Create.

And then do Journal

Voucher entry as follow:-

Path for

voucher creation: - G.O.T. (Gateway of Tally)--> Inventory Voucher--> Press F7 (Journal Voucher).

Press F5 to open Payment Voucher.

See the VAT computation report:-

Path for

view VAT computation: - G.O.T. (Gateway of Tally)--> Display--> Statutory Report--> VAT Report--> VAT Computation.

Press ”Alt + F1” for more details.