VAT IN ACCOUNTING VOUCHER

VAT is

maintained in both Accounting and Inventory mode. If you want to maintain VAT

in Accounting Voucher then follow the steps given below.

To maintain:-

Create a company and then activate VAT as follow:-

To Activate

VAT: - G.O.T. (Gateway of Tally)--> Press F11

(Company Features)--> Press F3

(Statutory & Taxation).

After that press “enter”.

Again press “enter” many times.

Accept it by pressing “y” or “enter” key.

Create ledger as follow:-

Path for

ledger creation: - G.O.T. (Gateway of Tally)--> Accounts Info--> Ledger--> Create (Single).

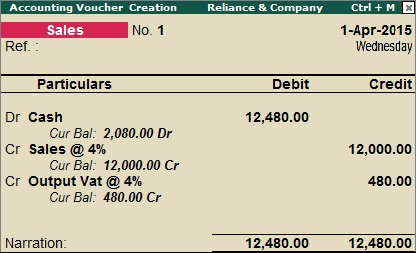

Now do voucher entry as follow:-

Path for

voucher creation: - G.O.T. (Gateway of Tally)--> Accounting Voucher--> Press F9 (Purchase Voucher).

Press F8 to open Sales Voucher.

Now you can see VAT computation follow:-

Path for

view VAT Computation: - G.O.T. (Gateway of Tally)--> Display--> Statutory Report--> VAT Report--> VAT Computation.

For more information, press “Alt + F1”.

This is really useful to every one who are interested to learn Tally ERP 9. Great Help to all and me

ReplyDeleteTally Training

Nice post about audit and thank you for the information that you gave to us.

ReplyDeleteVAT Training in UAE