VAT TAX CLASS

VAT Tax

Class is used to pre - define a ledger specified in Purchase/ Sales Voucher.

Working

steps:-

Create a company and then activate VAT as follow:-

To Activate

VAT: - G.O.T. (Gateway of Tally)--> Press F11

(Company Features)--> Press F3

(Statutory & Taxation).

And then

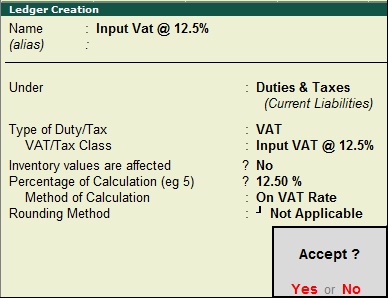

create ledger as follow:-

Path for

ledger creation: - G.O.T. (Gateway of Tally)--> Accounts Info--> Ledger--> Create (Single).

Create stock master as follow:-

To Create

Stock Group: - G.O.T. (Gateway of Tally)--> Inventory Info--> Stock Group--> Create.

To Create

Stock Item: - G.O.T. (Gateway of Tally)--> Inventory

Info--> Stock Item--> Create--> Press F12 (Configuration).

Now alter in voucher types (purchase and sales) as follow:-

Path for Purchase Voucher Type Alteration: - G.O.T. (Gateway of Tally)--> Inventory Info--> Voucher Types--> Alter--> Purchase.

Path for Sales Voucher Type Alteration: - G.O.T. (Gateway of Tally)--> Inventory Info--> Voucher Types--> Alter--> Sales.

After that do purchase voucher entry:-

Path for

voucher creation: - G.O.T. (Gateway of Tally)--> Inventory Voucher--> Press F9 (Purchase Voucher)--> Purchase Class.

And then do

sales voucher entry:-

Path for

voucher creation: - G.O.T. (Gateway of Tally)--> Inventory Voucher--> Press F8 (Sales Voucher)--> Sales Class.

You can see the VAT computation:-

Path for

view VAT computation: - G.O.T. (Gateway of Tally)--> Display-->Statutory Report--> VAT Report--> VAT Computation.

Now create

voucher types:-

Path for Voucher Type Creation: - G.O.T. (Gateway of Tally)--> Inventory Info--> Voucher Types--> Create.

And then do Journal

Voucher entry as follow:-

Path for

voucher creation: - G.O.T. (Gateway of Tally)--> Inventory Voucher--> Press F7 (Journal Voucher).

Press F5 to open Payment Voucher.

See the VAT computation report:-

Path for

view VAT computation: - G.O.T. (Gateway of Tally)--> Display--> Statutory Report--> VAT Report--> VAT Computation.

Press ”Alt + F1” for more details.

its been very informative, thanks for your kind help

ReplyDeleteJob Typing

Step by step guidance on VAT TAX and managing VAT records. It is helpful for everyone. If you want to Know more information about VAT TAX in UAE, Please Visit Site : https://www.vatuae.me/

ReplyDeletePlus commercial information services offer you business setup local sponsorship services in UAE especially at Abu Dhabi. We are the current leader in business consultancy

ReplyDeleteThank you for taking the time to provide us with your valuable information.

ReplyDeleteVAT Consultants in UAE

Vat returns fillings require pro

ReplyDeletehttp://vfmaccounts.ae/vat-return-in-dubai/

Could you explain about vatable expenses entries other than purchase and sale. In UAE purchase and sale rate is single rate 5% and expenses as well.

ReplyDeleteIn Purchase and sale we book only one entry showing VAT amount and it stands as debtor or creditor, and while making any vatable expenses for the organization in that time it is required to pass two entry, one is journal and another is payment.

Suppose, DEWA Bill paid 2000/- Including VAT.

Solution:Journal voucher DEWA Bill for XYZ Location Dr.1904.76

INPUT Vat Dr.95.24

Dubai Electricity and water authority Cr. 2000/-

Payment Voucher

Dubai Electricity & water Authority Dr.2000/-

Cash/Bank cr. 2000/-

Here it is required 2 entry for every vatable exp. so, is there any other entry ???

can we show VAT entry in payment voucher. if we pass one entry in payment voucher showing VAT therefore there will no double entry system accounting.

ReplyDeletein purchase and sale there we only book purchase and sale it it stands debtor or creditor and while we make payment or receipt amount against the INV it becomes double entry.

If you want the opening loan account and business loan account, Mashreq Alislami bank is provide the Islamic business loan.

ReplyDeleteIt's awesome designed for me to have a website, which

ReplyDeleteis useful in favor of my knowledge. thanks admin . PLease check link instagram viewer to see top hashtag on instagram.

Just fill in your basic details here. One of our GST Experts will call you and clarify all your doubts and then we will get your Online GST Registration in Chennai done here.

ReplyDeleteGST Registration in Chennai

ReplyDeleteI am heartily impressed by your blog and learned more from your article. Thank you so much for sharing with us. I find another blog like it. If you want to look, visit here Vat Software in Bangladesh , It’s also more informative.

This is an excellent resource for anyone looking to understand VAT tax classification in Tally. It's great to see a clear breakdown of how to handle various VAT rates and exemptions within the software. For those new to this, it’s crucial to get the initial setup right to ensure accurate compliance. I found your guide on VAT accounting particularly helpful. know more about us! visit website

ReplyDeleteNice Post!!

ReplyDeletePlease look here at Corporate Tax Registration in Dubai

VAT compliance is another major area where businesses often face challenges. VAT Corporate Registration Services in UAE provided by Ibrahim Accounts and Tax Solutions LLC ensure a smooth and error-free registration process.

ReplyDelete