COMPOUND OUTSTANDING INTEREST CALCULATION

If a businessman takes loan from

any bank, then interest is charged on outstanding balance.

If the businessman refunds the

balance by instalment, then the bank charges different rate of interest on all

instalments. It is called Compound Outstanding Interest

Calculation.

Example:-

A businessman takes loan of Rs.

1,00,000 from PNB. He decided to refund the loan in four equal instalments. The

bank charges different rates of interest that is 10%, 12%, 15% and 18% per 30

days.

Calculate the interest and record

the above transactions.

To maintain:-

First of all create a company and

then activate interest calculation and debit/credit note as follow:-

To Activate Interest Calculation and Debit/Credit Note: - G.O.T. (Gateway of Tally)--> Press F11 (Company Features)--> Press F2 (Inventory Features).

Now create ledger as follow:-

Path for ledger creation: - G.O.T. (Gateway of Tally)--> Accounts Info--> Ledger--> Create (Single).

After that do voucher entry:-

Path for voucher creation: - G.O.T. (Gateway of Tally)--> Accounting Voucher--> Press F6 (Receipt Voucher).

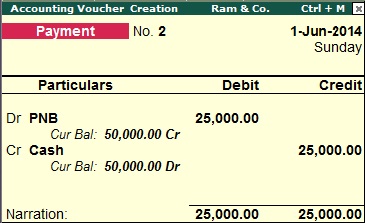

Now press F5 for Payment Voucher.

And then press F2 to change the

voucher dates follow:-

Now view the interest ledger of

PNB as follow:-

Path for view interest calculation: - G.O.T. (Gateway of Tally)--> Display--> Statement of Account--> Interest Calculation--> Ledger--> PNB.

Create voucher type as follow:-

Path for voucher type creation: - G.O.T. (Gateway of Tally)--> Accounts Info--> Voucher Type--> Alter.

When you will press “enter” key

on “Alter”, a list of voucher types will be open. You will select there “Credit

Note” as follow:-

Press “enter” key on “Credit Note”

and a form will open, fill as follow:-

After that press “enter” key and

then as follow:-

Press “enter” key.

Accept the voucher by pressing

“enter” key or “y”.

Now again do voucher entry as

follow:-

Path for voucher creation: - G.O.T. (Gateway of Tally)--> Accounting Voucher--> Press Ctrl + F8 (Credit Note).

Press “enter” on “Interest

Payable” and the voucher will be open as follow:-

Do voucher entry for payment of

interest as follow:-

Path for voucher creation: - G.O.T. (Gateway of Tally)--> Accounting Voucher--> Press F5 (Payment Voucher).

You can see the interest

calculation of PNB ledger as follow:-

Path for view interest calculation: - G.O.T. (Gateway of Tally)--> Display--> Statement of Account--> Interest Calculation--> Ledger--> PNB.

You can see that the above PNB

ledger is blank, it means that all the interest have been paid.